We deliver landmark transactions to the TV production, kids IP, advertising, marketing and creative services industries.

About

Our Approach

Whilst no two clients are the same, all of our clients are contemplating a transformational event in their professional careers. These will be defining moments in their personal lives too. Moments of high tension and high stakes. The lives of their teams and the destiny of the companies in which they’ve invested years of profits, sweat and tears. We take this responsibility seriously and personally.

We specialise in sell-side advisory for entrepreneurial businesses but have acted on all transaction types over time. We marry our transaction expertise with an obsessive focus on client service. No two situations are the same and no two clients, but the breadth and depth of our experience allows us to tightly tailor our client solutions to optimise outcomes.

Mergers & Acquisitions

We work with entrepreneurial businesses, owner-managed and private-equity backed, on transformational change through M&A. Selling or acquiring businesses, mergers, joint ventures, strategic alliances and disposals.

Our unrivalled understanding of our sector, the dynamics within our clients and their businesses and our personal access to domestic and international buyers enables us to identify and unlock strategic value and deliver it time after time, whatever the brief and the circumstances.

Strategic Advice

We help our clients identify and develop strategic options to grow or protect shareholder value. This may include international expansion, funding, stakeholder alignment, succession and exit planning, and resolution of conflicting shareholder objectives.

Whatever the opportunity or challenge, success is contingent upon all such advice being delivered objectively and empathetically. We pride ourselves on our track record, evidenced by our long-term relationships with clients, partnering them on multiple initiatives.

Fund Raising

We advise businesses on finding and negotiating the best terms for the right financing to allow them to achieve their full potential. Funding for growth, balance sheet restructuring and facilitating management succession.

Fundraising starts with a watertight business strategy set in a robust market context. Funding is also about finding a financial partner, not simply negotiating financial terms. By drawing on our extensive international industry expertise and investor network, we fine tune strategy and source the best-suited funding options, both equity and debt.

Our clients work

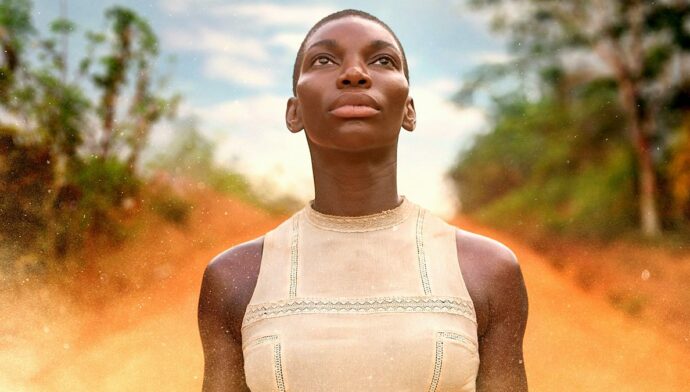

The most creative leaders in the industry trust us to deliver. Their work consistently inspires audiences from around the globe.